Call option simulator

As you move in price your. E-Futures International Trading Platform.

Call Option Profit Loss Diagrams Fidelity

Free options simulator to test your options strategyOnce the file is uploaded to optionscrack you can see the options chain and OI graph displaying the dataYou can create positions.

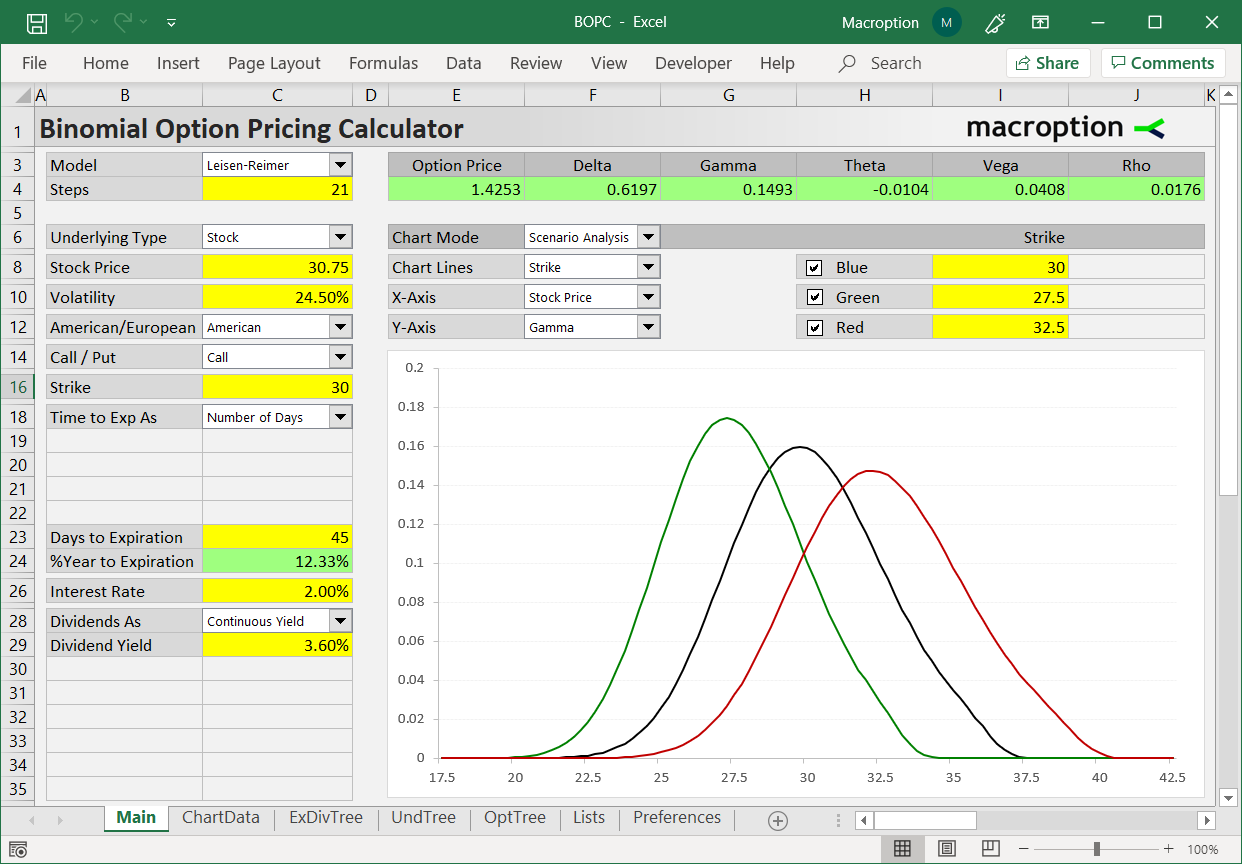

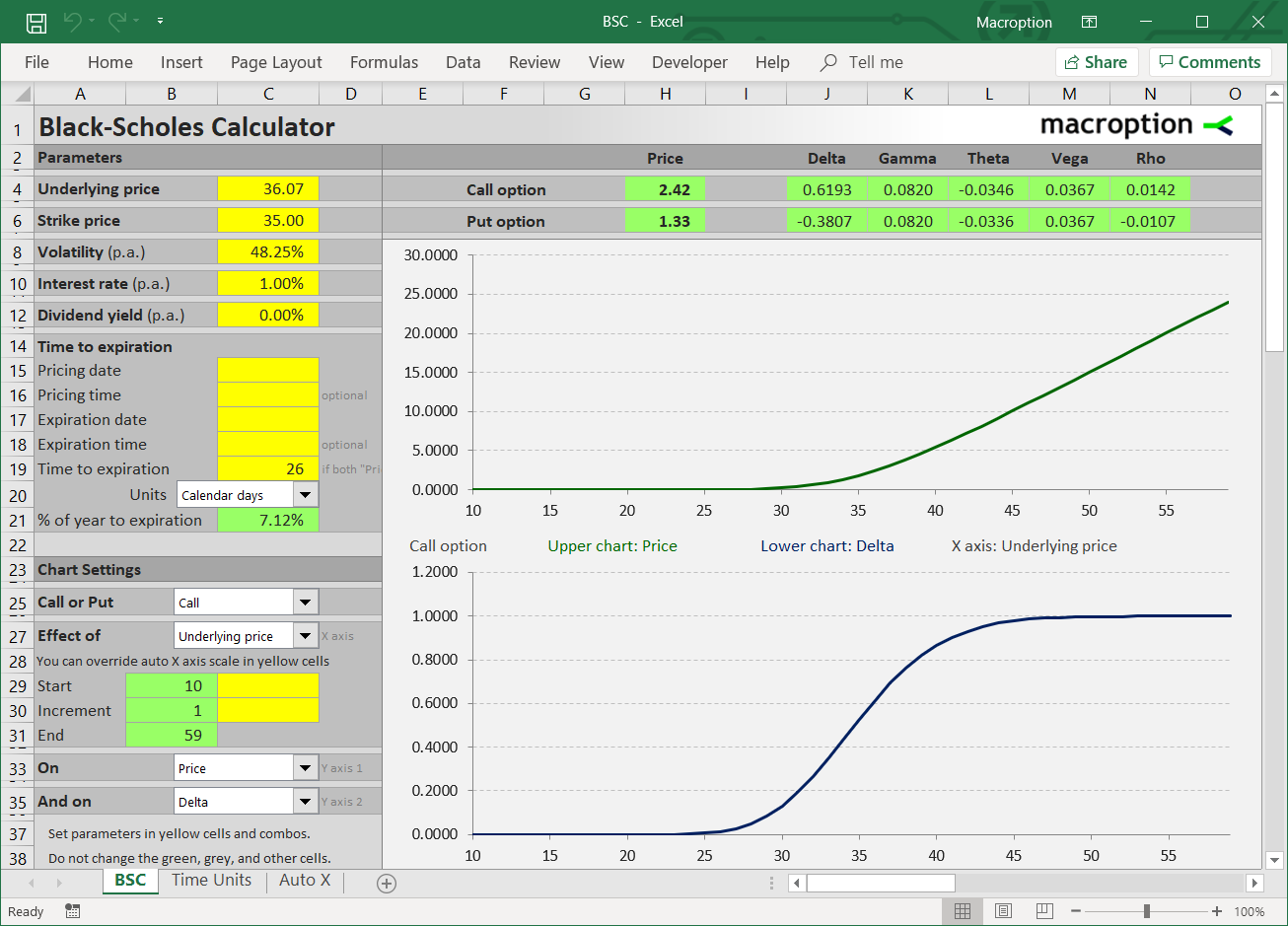

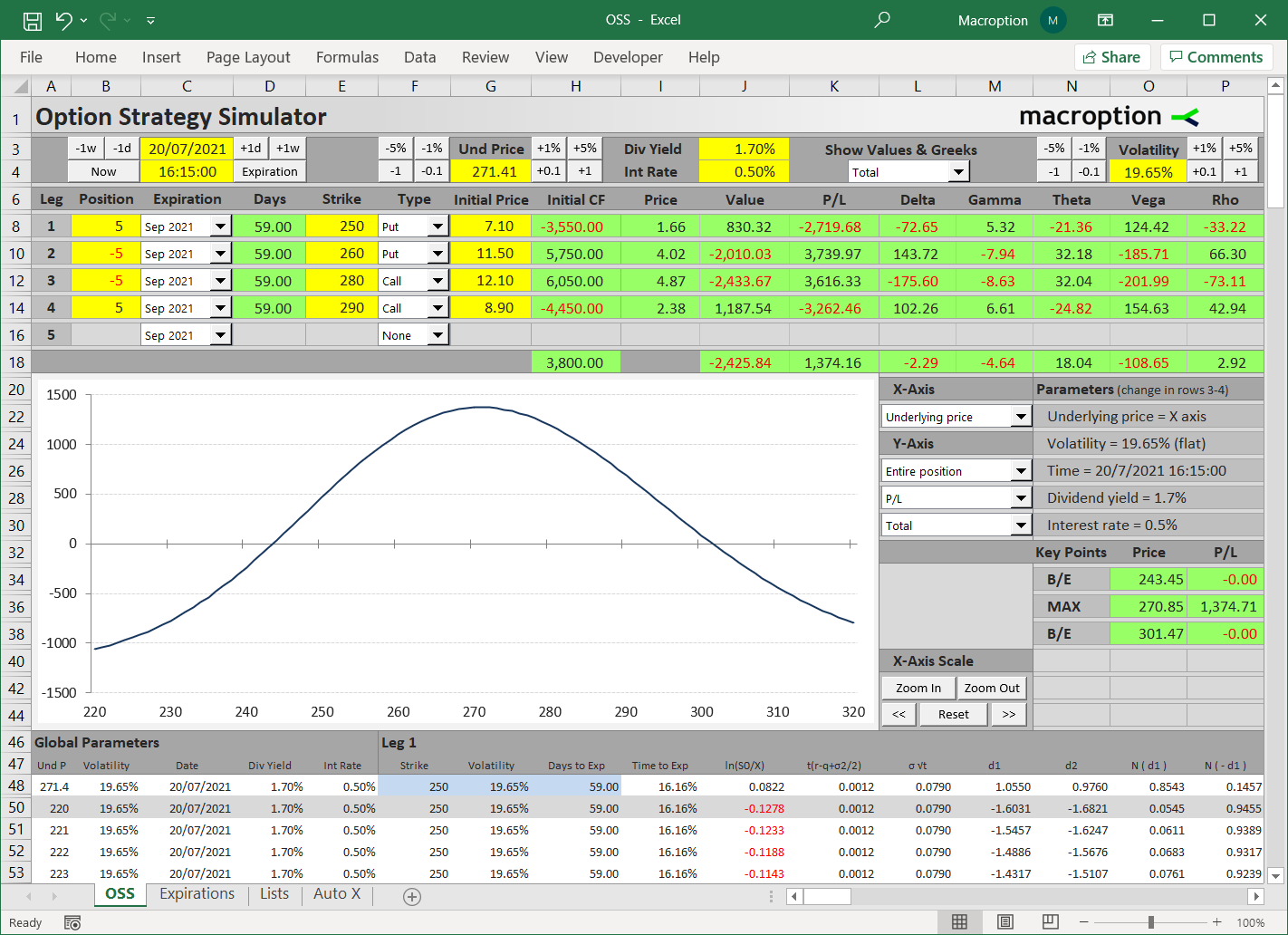

. Call Option Contract Simulator Live on Gatsby Cloud. How to read the graph. Manage your risk simulate scenarios and what-ifs quickly and easily in Excel.

Various brokers have tools you can use some of which are very good. There is an excellent software package for options traders called OptionVue. VIX options and futures.

You can trade call and put options but at this time the Simulator does not support writing options. ETNA Trading Simulator. When purchasing a call option you are buying the right to purchase.

Instantly calculate aggregate Greeks and break-even points. Stock Symbol - The stock symbol that you purchased. Options Type - Select call to use it as a call option calculator or put to use it as a put option calculator.

Use our free trading simulator to practice trading risk-free and commission free. The Money Press Method Is Refreshingly Different. Take Your Options Trading to the Next Level with Innovative Tools Educational Resources.

Ad Our Brokers Are Always Here to Assist You. This app calculates the gain or loss from buying a call stock option. Of course this is not free.

Ad Discover how my Weekly Paycheck Method tripled account in 8 mo. Ad Manage volatility w a tool that directly tracks the vol market. Copies of this document may be obtained from your broker from any.

Get your Free Copy here. The simulation produces a large number of possible outcomes along with their probabilities. Download E-Futures International Trading Platform - Try A Free Demo.

Use this web simulator to generate realistic option contract scenarios before entering the market with real money. Ad Download Smart Options Strategies free today to see how to safely trade options. VIX options and futures.

Ad Webull paper trading helps investors and traders practice their trading skills. Universities educators and brokers Paper Trading Platform offers life-like execution for ETF equities and. Ad Manage volatility w a tool that directly tracks the vol market.

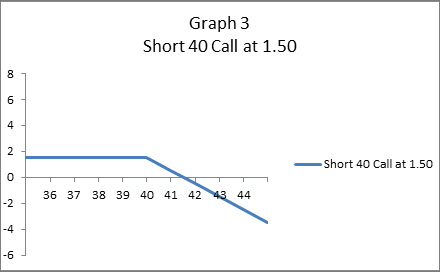

The gain or loss is calculated at expiration. Ad The How to guide on trading options and the 5 laws of options you must obey. The X-axis shows the price of the underlying and the Y-axis shows your PnL.

The simulators spread input is for the entire position for the period so in the typical 90 cash 10 call setup a 5 option spread would amount to a spread of 5 for the entire position. Profile Type Output. In summary its used to simulate realistic scenarios stock prices option prices.

With over 40 years experience in options trading we have a robust set of tools. This free guide contains an easy 3 step process to trade options in todays market. The Investopedia Simulator will help you gain confidence before risking your own money.

Side QTY Type Expiration Strike Price Total. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. Learn How To Trade Options Like The Pros.

The black line represents your Profit Loss PnL curve. Ad Our tools and algorithms help investors design option strategies. It Turns the Tables.

A trading simulator used by many US.

Options Spread Calculator

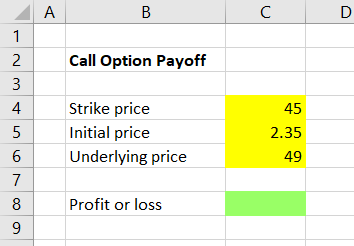

Calculating Call And Put Option Payoff In Excel Macroption

Thinkorswim Papermoney Options Trading Simulator Tutorial Youtube

Long Call Option Strategy For Beginners Warrior Trading

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Macroption Option Calculators And Tutorials

Macroption Option Calculators And Tutorials

Call Option Calculator Put Option

Macroption Option Calculators And Tutorials

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Options Spread Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

A Beginner S Guide To Call Buying

Long Call Calculator Options Profit Calculator

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

5 Best Options Trading Platforms For 2022 Stockbrokers Com

Calculating Call And Put Option Payoff In Excel Macroption